- Log In Fast

- Manage It All

- Deposit From Anywhere

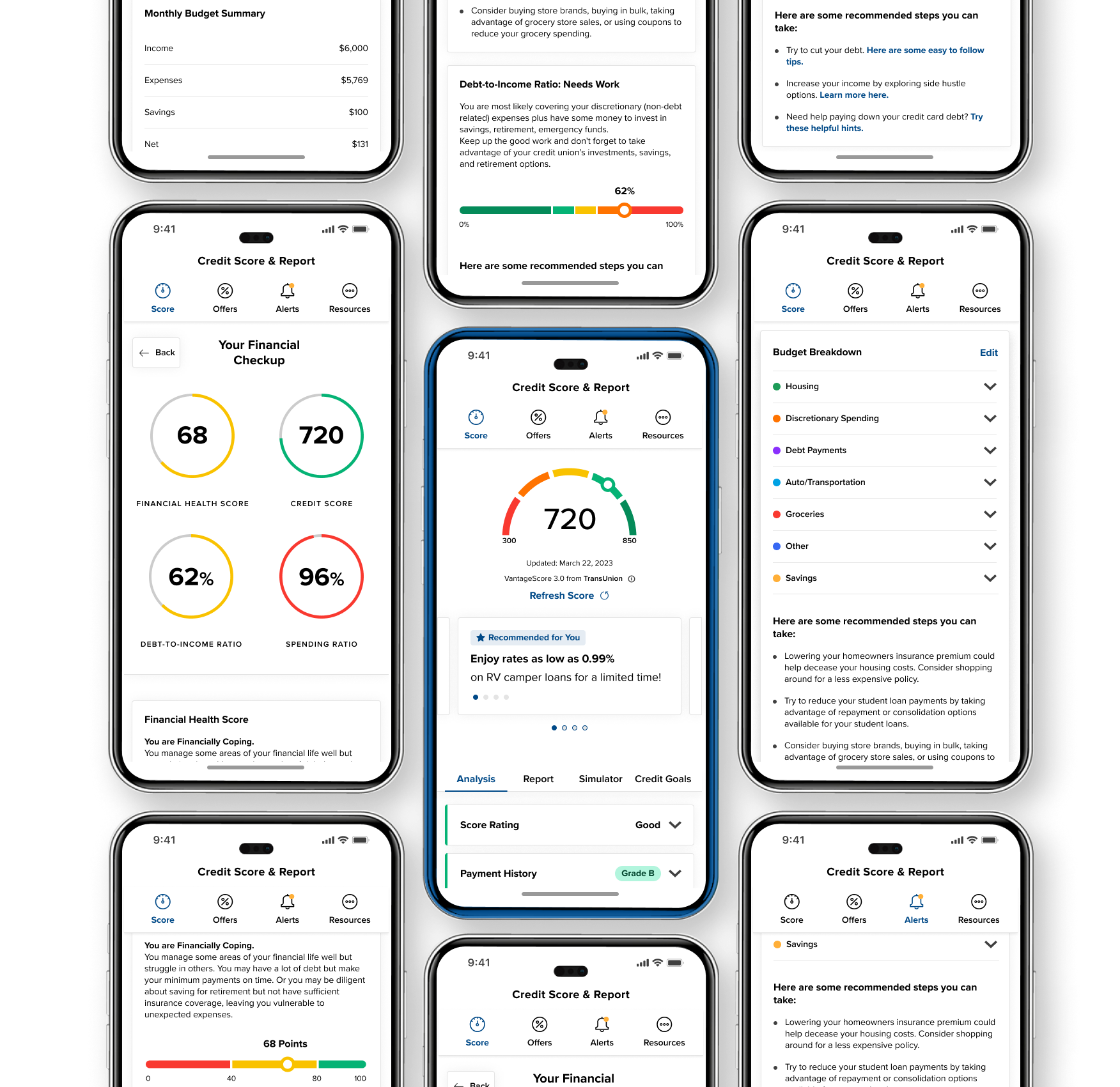

Your credit score and credit report are important to your financial wellness.

As an ACU of Texas member, we provide you with safe and easy access to your credit score and report, anytime and anywhere. And there is more! You can access the following features within the Credit Score feature in Digital Banking:

.png?sfvrsn=54aac1d4_0)

Your credit score is an extremely important part of your financial life. It is based on several factors which includes your payment history, credit utilization, your mix of credit, and recent credit activity. Luckily, it’s not difficult to establish a healthy credit score once you understand how it works. Our free Credit Score tool helps you not only understand these factors but also gives you tips in improving your score too.

This feature offers you a personalized plan to enhance your credit score. It provides detailed information on actions that can have the most significant impact on your score, helping you make informed decisions.

Understanding your score may feel daunting, but with Credit Score, you get complete visibility into what factors affect your score and tips to help you improve it. Use these tools to your advantage when you access Credit Score in ACU of Texas Digital Banking.

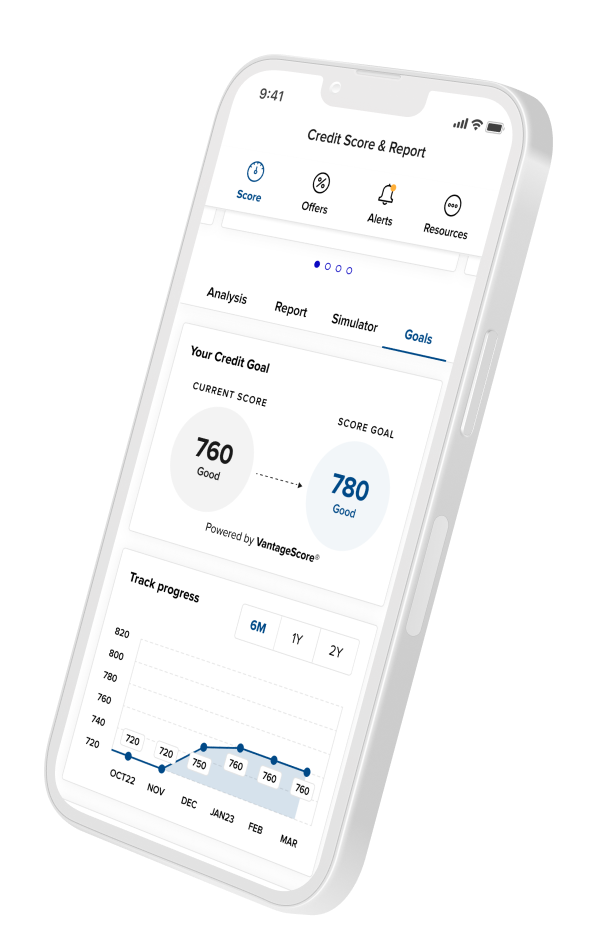

Do you have financial goals? Do you want to improve your credit score to achieve those goals? Whether buying a house, a car, or anything requiring a loan or if you're going to rent a new apartment or improve your overall creditworthiness, Credit Score has tools that can help you.

Set a credit score goal, receive personalized recommendations, and track your progress toward your goal. You can edit your goal anytime, and you will receive messages when meeting milestones to encourage you along the way.

.png?sfvrsn=11be32e_0)

Our easy-to-use Score Simulator within Digital Banking can take away the “what ifs” and generate an approximate credit score that will help you see where you stand. The simulator is an easy way to gain valuable insights into your future eligibility for loans and credit cards.

How does the Credit Score Simulator work? The tool will share how much your credit score might increase or decrease based on your specific financial decisions.

Financial decisions such as:

Discover how different financial decisions can impact your credit score, and financial health while making reaching your goals easier than ever.

When you become an Associated Credit Union of Texas member, you become part of everything we do to improve the quality of life in our community.

Last year, we provided $5,923,116 in savings to our members, saving each household approximately $281.

I am very happy with the services ACU provides.Maria – Member

The ACU of Texas Mobile app allows you to view your transaction history and account balances, pay bills, make transfers and locate our nearest ATMs and branches!